According to Citibank’s forecast for the end of 2021, the price of Bitcoin will rise to $ 318 thousand (https://www.nasdaq.com/articles/citibank-analyst-says-bitcoin-could-pass-%24300k-by-december-2021-2020-11-16) . So is this possible?

I think we can answer this with a short analysis.

First of all, we have entered the last turning point of this year. This means that both gains and losses are possible. A smart investor takes a worst-case scenario. In other words, it is useful to take a position as if Bitcoin is going to enter a bearish season.

Investors know well that rising seasons are always followed by bearish seasons.

https://www.investing.com/analysis/bitcoins-price-action-rhymes-with-1970-gold-markets-says-citibank-200544659

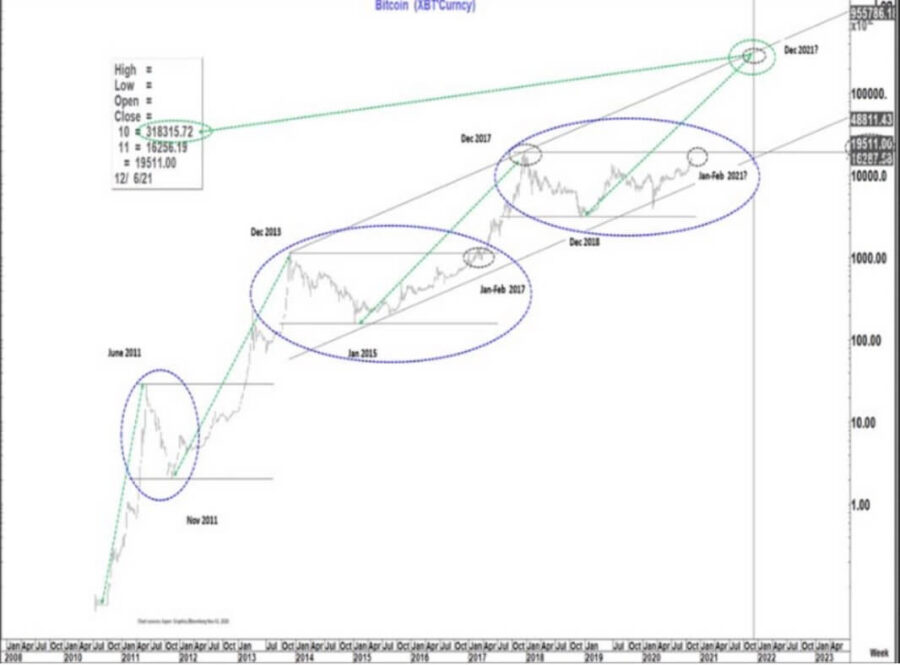

The chart is taken from Citibank’s technical analysis for Bitcoin. When we look at the chart, we can see the rising and falling seasons of Bitcoin since 2010. According to the analysis made considering the trends in these seasons, the price that Bitcoin can reach towards the end of this year is above $ 318 thousand.

Bitcoin is called today’s gold. As you know, I have stated in my previous articles, gold and silver are real money. Bitcoin is also seen as a commodity just like gold and silver due to its limited production. This again requires a tight bond with interest, just like in gold and silver. That is, with real interest rates. If we look at it, real interest rates in America, for example, real interest rates on 10-year treasury bills are around minus 1.16 percent. What does this mean? This means increasing demand for commodities like gold, silver and bitcoin.

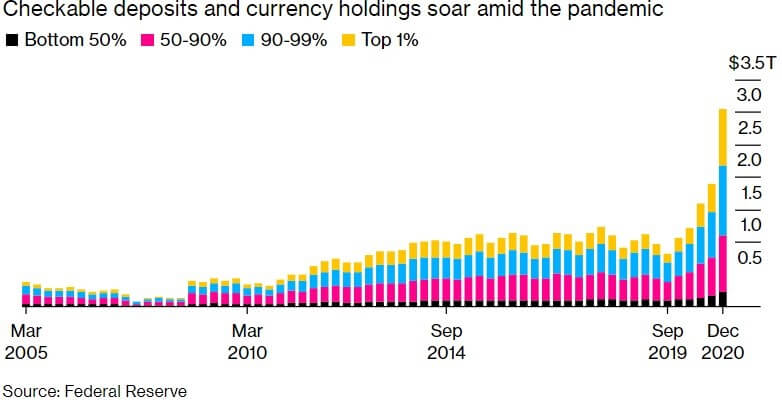

In the chart, we see the rise of checkable bank depoists after 2020.

What does this mean?

When the wages paid to people even though they are not working are added, it seems that the demand deposits in bank accounts increased from around 800 billion dollars before 2020 to 3 trillion dollars. When the interest rates turn negative in real value, deposits close to 3 trillion dollars await where they will go to invest. Why not bitcoin?