There was something I mentioned in my previous post. Reverse repurchase agreements. Why does the Fed make a reverse repurchase agreement? To borrow money from large banks and financial institutions with high guarantees. It gives them repurchase agreements and narrows their reserves. Of course, he buys these collaterals back with interest after a while.

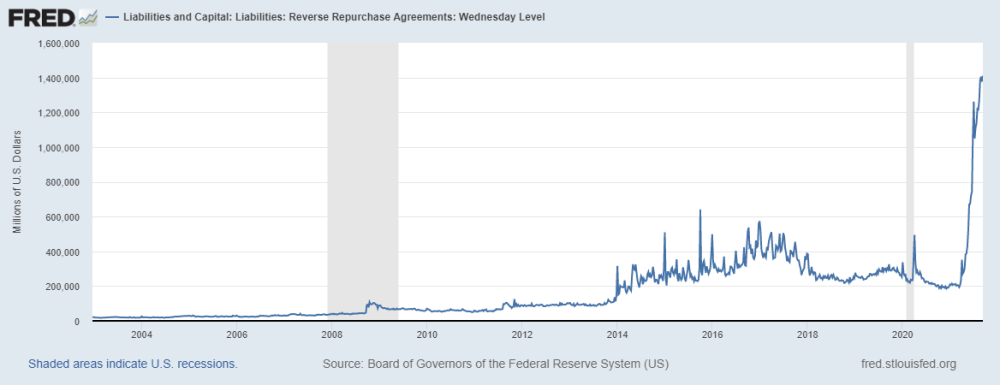

Source: https://fred.stlouisfed.org/series/WLRRAL

As can be seen in the graph, the Fed has made a reverse repurchase agreement of approximately 1.4 trillion dollars as of September 8, 2021. The previous high was around $1.05 trillion dollars in June. Obviously the Fed is collecting cash from the markets.

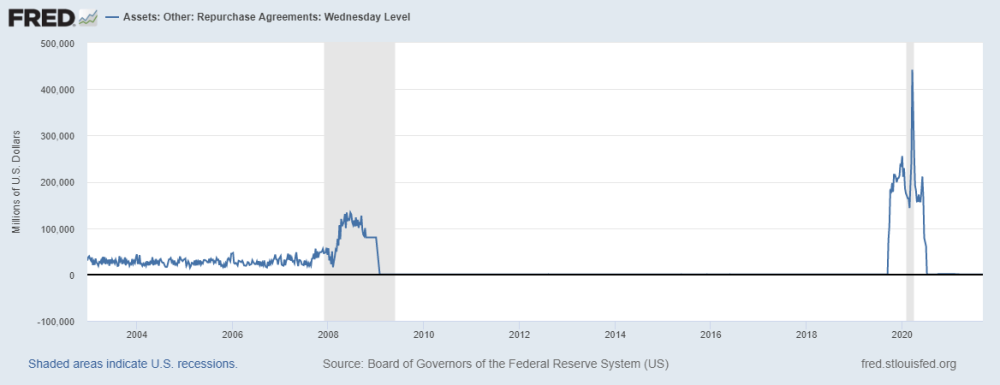

Source: https://fred.stlouisfed.org/series/WORAL

Now let’s take a look at repurchase agreements. Repurchase agreements, which were around 22 billion dollars until 2008, increased 7 times to 144 billion dollars after the crisis. Reverse repurchase agreements, on the other hand, cost around $40 billion at the same time.

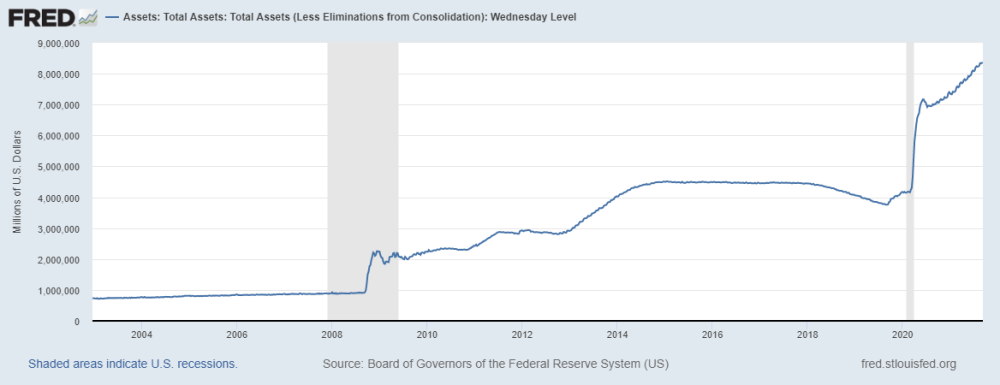

Source: https://fred.stlouisfed.org/series/WALCL

Finally, when we look at the Fed’s total assets, we don’t see an increase of around 1 trillion dollars between June and September. However, between these two months, he had made nearly as many reverse repurchase agreements. that is, it had narrowed the reserves of the banks. These reserves must pass into the Fed’s reserves. In this case, where could this amount be? Any ideas?