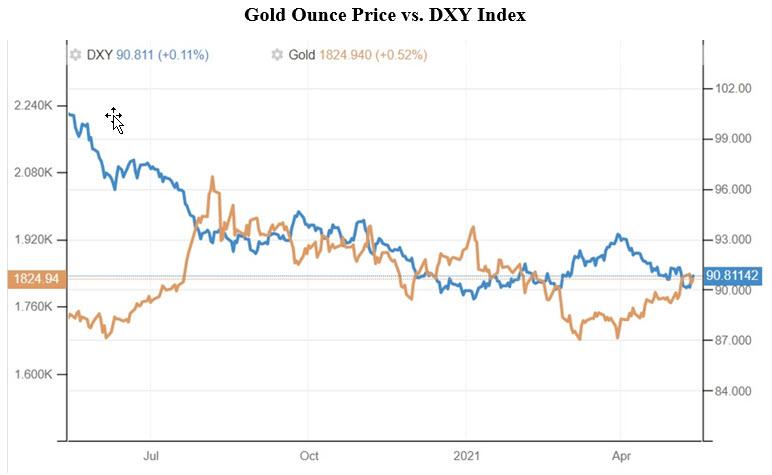

There has always been an inverse relationship between gold price and the dollar. One of the measurement scales of the demand for the dollar is the DXY index, which is the average index of the dollar equivalent of 5 countries’ currencies. If the DXY index is increasing, it means that the demand for dollars in the world is increasing. As can be seen in the graph, the reverse relationship between the dollar DXY index and the gold ounce price in the last year is quite clear. With the DXY rising, the gold price is falling and vice versa. The DXY index has started to decline accordingly, as the reserve currency of the dollar has weakened more and more, and gold has started to attack. This was an expected development.

Source: https://tradingeconomics.com/united-states/currency