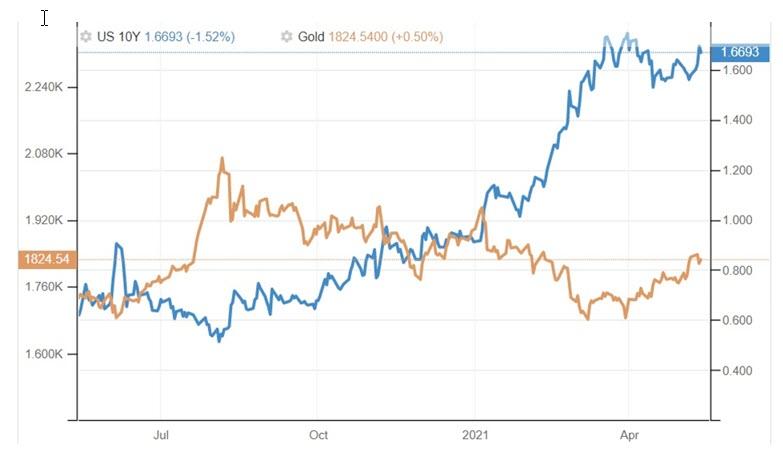

American treasury bonds are also a reliable store of value, just like physical gold. Therefore, when the demand for American bonds increases, the demand for gold decreases. This pulls the price down. The opposite is also true. When there is a fall in bond interests, gold attacks occur. Generally, the demand for American bonds increases in times of crisis. This increases the bond prices and decreases the interest rates. When the crisis deepens, deflation and a safe haven starts a gold rush. This time, gold is safe. As seen in the chart, there is a negative relationship between gold prices and US bond rates. In these days, when the confidence in the dollar is beginning to shake, the gold attack has started. The gold investor never loses. Of course, if it is physical gold.

Source: https://tradingeconomics.com/united-states/government-bond-yield