The years in which the international bond market entered a rapid expansion period are the early 1980s. The international bond market, a market for foreign currency bonds issued and traded across national borders, has played an important role in the internationalization of capital markets since 1980.

After the collapse of the Bretton Woods system in 1971, floating exchange rates were started with the dollar, which was started to be printed unlimitedly, and the Euro-bond market entered a new process. The majority of euro-bonds issued in the 1970s were issued in dollar terms. In those years, the bond market accounted for about a third of the financial system (Benzie, R. (1992). “The Development of the International Bond Market.” BIS Economic Papers, Bank for International Settlements 32.).

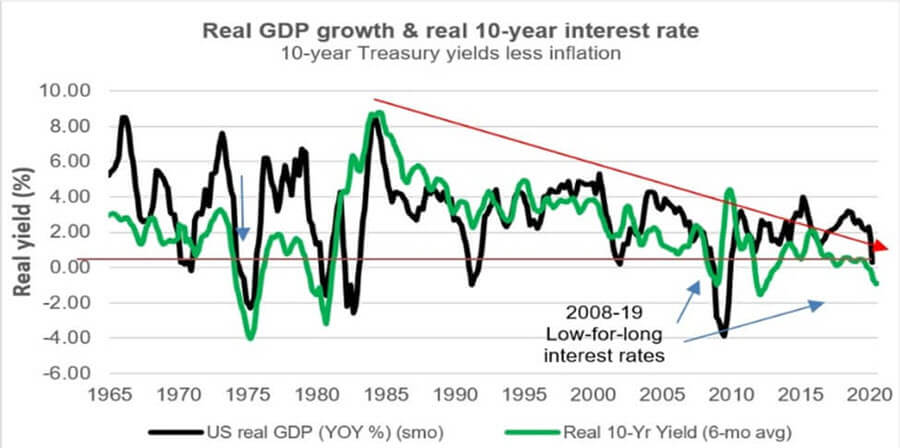

Today, it constitutes two-thirds of the world financial system with a volume of approximately 600 billion dollars. As can be seen in Figure, the American bond yields, which have been falling continuously since 1980, have accumulated tremendous energy in the market.

Source: www.realeconomy-rsmus.com