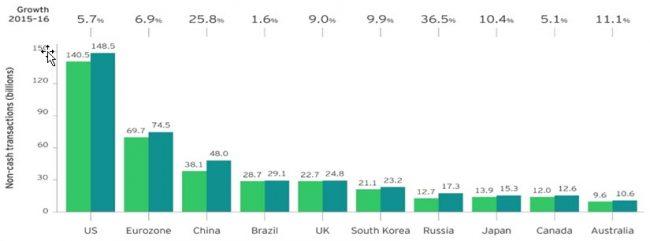

In the information economy, the digitalization of money as in production systems leads to a gradual decrease in the use of cash in economic transactions. In fact, it is costly in cash production, transportation and storage. In the Figure, the increase rates in non-cash transactions in major countries between 2015 and 2016 are given. The country with the largest decrease in cash usage is Russia with an increase of 36.5%, followed by China with 25.8%. In the USA, this rate increased by 5.7%. In short, although the transition from cashing out varies significantly between countries, it is actually almost global.

In the new economic system where money has entered the digitalization process, the concept of “Cashless Society” has become a frequently discussed concept. The cashless society, in short, is a situation where all kinds of financial transactions are made electronically in the digital environment, not with the usual physical banks and coins (Chakravorti and Mazzotta 2013). For example, the bill submitted to the US Senate in June 2020, the bill, code S3571, briefly passes the following topic: “The bill includes Federal Reserve Banking’s digital transition accounts for residents and citizens and businesses residing in the United States (i.e. Among other things, these accounts are required to provide certain banking services to eligible individuals who choose to deposit funds into these accounts, including access to covid-19 (i.e. 2019 coronavirus disease) and payments. These accounts may not charge fees or it may not have balance requirements and must provide a specific interest rate.

Source: The End of Cash, The Economist, Intelligence Unit

I will write about this topic from time to time. Click for a larger version.

Good Morning everyone ! can anyone suggest where I can purchase CBD Coffee?