As I mentioned in my previous articles, one of the most important indicators of the crisis is the real estate price index. Various indices have been developed for real estate prices. One of them is the S&P case-Shiller Home Price Index. The Case Shiller home price index is an index that tracks changes in home prices in the United States.

Developed by three economists in the 1980s, Allan Weiss, Karl Case, and Robert Shiller, the Case-Shiller Home Price indices are used as the primary pricing mechanism in CME real estate futures and options. (https://www.investopedia.com/terms/s/sandp_case_shiller_index.asp)

The national housing price index, which covers the nine major census divisions, is calculated on a monthly basis (https://www.investopedia.com/terms/s/sandp_case_shiller_index.asp).

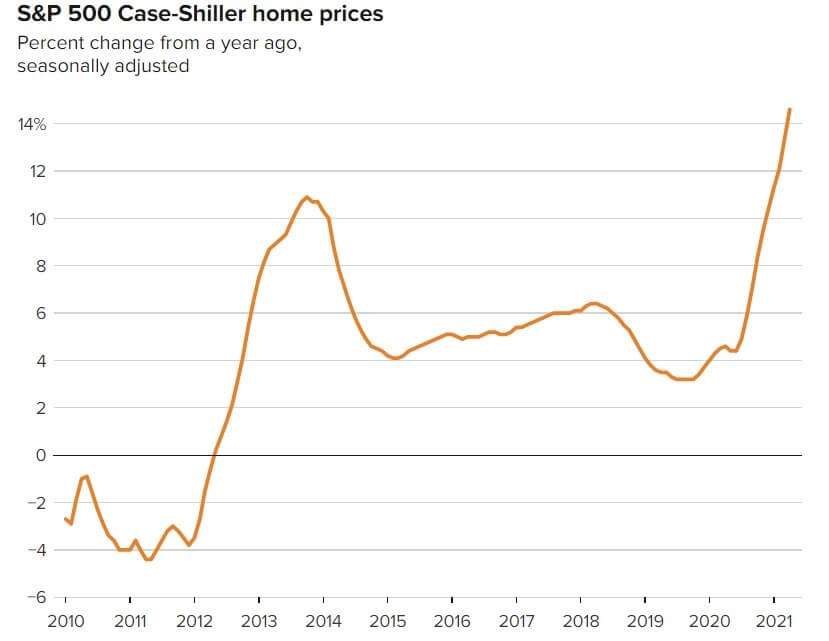

In the graph, we see that the increase in real estate prices is quite high compared to the previous year. While the real estate price index increased by approximately 5% in the middle of 2020, the increase increased to 15% this year, which corresponds to the same period. This astronomical increase is one of the important indicators of the ballooning in real estate prices.

These high prices may decrease after a period. That is, since the high prices are profitable, the real estate supply will increase, which will bring the prices down over time. In fact, according to another alternative, while the rapidly increasing unrequited money printing pushes the prices even higher, it may also mean that the real value of the property decreases with inflation.

Actually, it doesn’t seem like a good time to invest in the real estate market. When it comes to investment, for some reason, people tend to buy when prices are rising rather than falling. This is completely wrong investment behavior. Conversely, it is necessary to sell when prices are rising. This should be a valid strategy for precious metals as well.

The possible monetary policy of the FED may not be to increase the interest rates in the near future in order to keep the market balanced. This means either negative interest rates. It looks like it will continue to keep interest rates below inflation. The FED buys an average of 130 billion dollars of assets every month, trying to put a wedge into the fragility in the markets. How sustainable is this? Exactly at this point, the IMF chief’s statement that a new Bretton Woods arrangement is needed indicates that the big reset is approaching. Because the monetary system is dead since 2008 and unsustainable as such.

From the graph, we can also understand that things are quickly getting out of control. We can predict that this index, which has increased by approximately 14 percent since January, may exceed 20 percent if the annual average is taken. This is an indication that things are out of control. It also gives an idea that the great crisis is now visibly approaching.

This also shows that the bubble in the real estate market is very close to bursting. Finally, the increase in prices in the real estate market is, of course, one of the results of the unlimited printing of money. The Fed continues to buy mortgage loans. How long can this continue? What happens to the real estate market when it is necessary to raise interest rates to control inflation? What is the extent of the collapse of the market if the interest rates increase while the low interest rates are the reason why people prefer this market? If this scenario happens, will other bubbles be triggered by the bursting of the real estate bubble?