For fifty years, something has been quietly breaking. Nobody talked about it much. It was boring. It was technical. It was happening in Japan.

But maybe this boring thing in Japan was actually the most important thing in the entire global financial system.

The Bank of Japan was the last fortress. The final defender of ultra-cheap money. The last central bank still pretending that negative interest rates and unlimited money printing could work forever.

Now that fortress is cracking. And when it falls completely, what happens to everything that was built on top of it?

The Carry Trade Systemic Risk

The yen carry trade has been called “the quiet engine of global risk” – now that engine is reversing. Source: Various financial institutions, BIS

The Quiet Engine Nobody Talks About

Let me tell you about something worth between one and four trillion dollars. Most people have never heard of it. It does not make headlines. It does not have a Twitter account.

It is called the yen carry trade.

Here is how it works: You borrow Japanese yen at almost zero interest. You sell those yen and buy dollars or euros or anything else. You invest in US stocks, real estate, crypto, emerging market bonds – whatever gives you a return.

As long as Japanese rates stay at zero and the yen stays weak, you make money. Easy money. Safe money. Boring money.

For decades, this was the foundation under global markets. Trillions of dollars flowing from Japan to everywhere else, chasing returns, inflating asset prices, keeping everything liquid and smooth.

This is not just a trading strategy. This is a symptom of something much bigger and much more broken.

When one country keeps interest rates at zero for thirty years, when money becomes essentially free, when you can borrow unlimited amounts at no cost – this is not normal capitalism. This is not a market economy.

This is what happens at the end of a fiat currency cycle. This is what desperation looks like when it wears a suit and speaks in central banker language.

What Is the Carry Trade? (And Why It’s Not What You Think)

The textbooks will tell you the carry trade is an arbitrage strategy. You exploit interest rate differentials between countries. Very technical. Very sophisticated.

But let me tell you what it really is.

The carry trade is what happens when the price of money gets completely disconnected from reality. When central banks manipulate rates so far below where they should be that massive distortions appear in the system.

Think about it. Japan had negative interest rates from 2016 to 2024. Negative. They were paying people to borrow money.

At the same time, US rates were 4-5%. Emerging markets were 7-10%. Even European rates were positive.

So what do you think happened? Money flowed out of Japan like water through a broken dam. An estimated $1 trillion to $4 trillion. Some people think even more.

That money went everywhere. Into Silicon Valley tech stocks. Into Miami real estate. Into Turkish bonds. Into Bitcoin. The yen carry trade was the invisible hand lifting every asset market on the planet.

And here is the key point: This was not driven by economic fundamentals or productivity or innovation. This was driven by central bank manipulation. By artificial money. By a dying system trying to keep itself alive just one more day.

The yen carry trade is not a bug in the system. It is a feature. It is the system working exactly as designed in the late stages of fiat currency collapse.

The Last Fortress: Why BOJ Matters More Than You Think

After 2008, all the major central banks went crazy with money printing. The Federal Reserve. The European Central Bank. The Bank of England. Quantitative easing everywhere. Rates to zero everywhere.

But by 2015-2016, most of them started thinking about normalizing. The Fed began hiking in 2015. Others followed eventually.

Except Japan.

Japan kept going. Deeper into negative rates. More bond buying. More yield curve control. While everyone else was trying to find the exit, Japan was building a bigger fortress of ultra-loose policy.

Why? Because Japan could not afford to stop. The whole world had become dependent on cheap yen. The global carry trade was too big. Too interconnected. Too systemic.

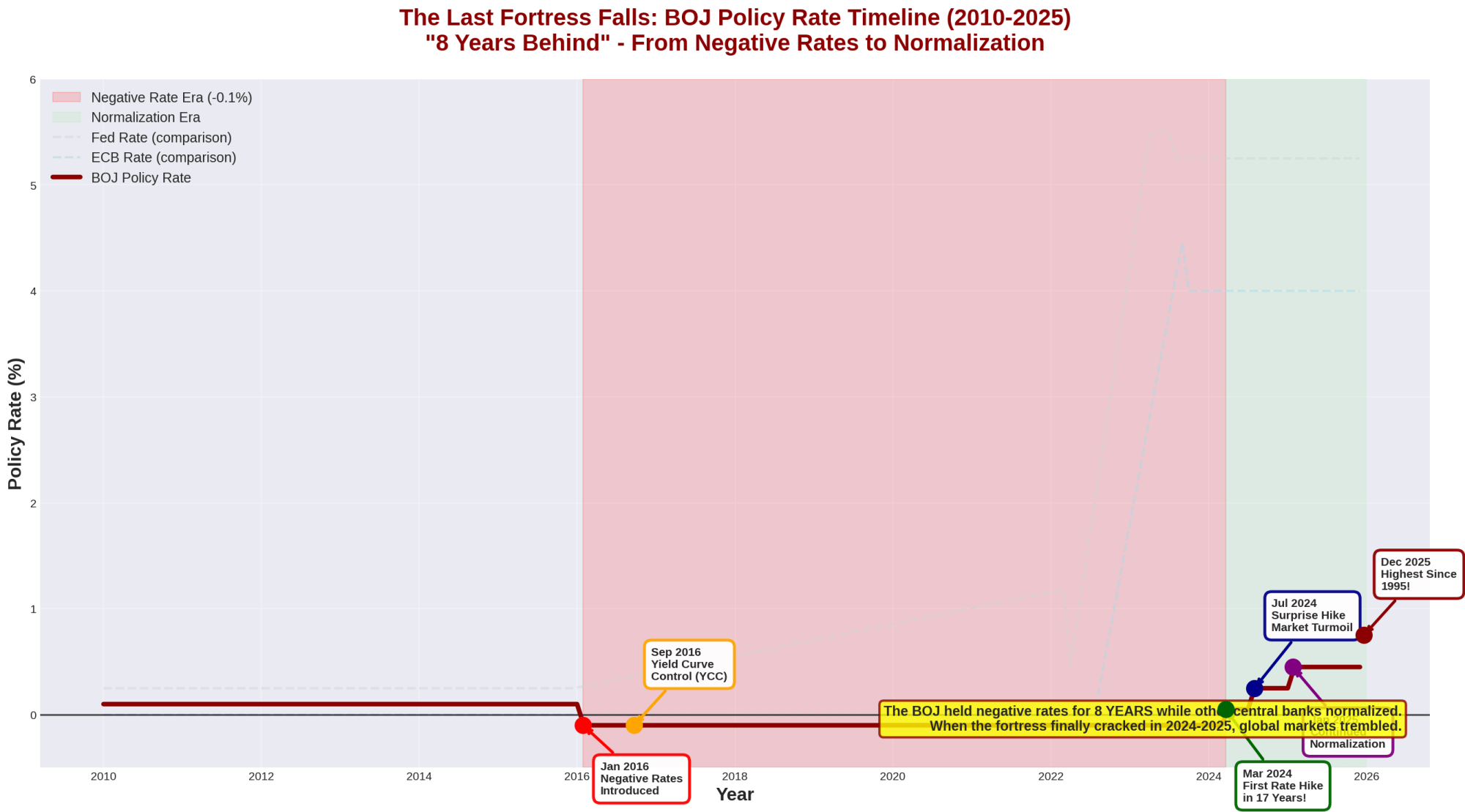

BOJ Policy Rate Timeline

The Bank of Japan held the line at negative rates for 8 years while the world moved on. Now they’re hiking. Source: Bank of Japan, Trading Economics

Look at that chart. From 2016 to 2024, BOJ rates stayed negative while Fed rates went from zero to 5%. That gap – that difference – that was the fuel for trillions in carry trades.

The BOJ became the last source of truly free money in the world. The final reservoir of unlimited liquidity. When banks, hedge funds, and corporations needed cheap funding, they went to Japan.

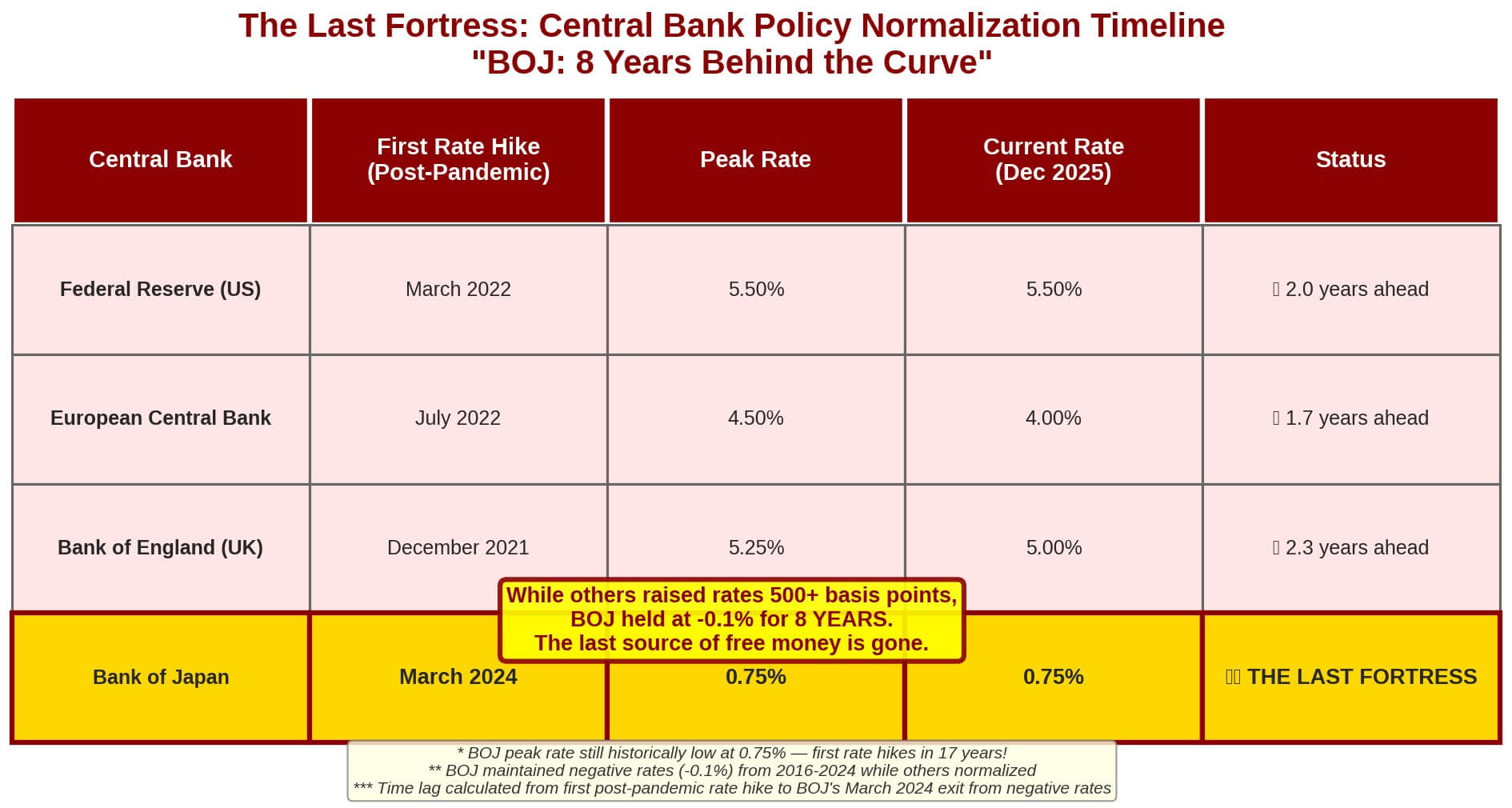

Here is how far behind Japan fell compared to everyone else:

Central Banks Comparison

While other central banks normalized policy, Japan stayed at negative rates. The divergence created the largest carry trade in history. Source: Central bank data synthesis

But here is the question nobody wants to ask: Why was Japan the last?

The optimistic answer is that Japan had unique deflationary problems and needed special solutions.

The pessimistic answer – the real answer – is that the global system was so fragile, so leveraged, so dependent on cheap money that someone had to keep the spigot open. If Japan had normalized like everyone else, the whole thing would have collapsed years ago.

Japan was not the last fortress by choice. Japan was the last fortress because the system could not survive without at least one source of free money.

Now even that is ending.

August 2024: The Day the Fortress Cracked

March 2024 was historic. For the first time in 17 years, the Bank of Japan raised rates out of negative territory. From -0.1% to a range of 0-0.1%.

The markets barely noticed. It was a tiny move. Symbolic more than anything.

But then came July 2024. Another hike, to 0.25%. And this time, the market did notice.

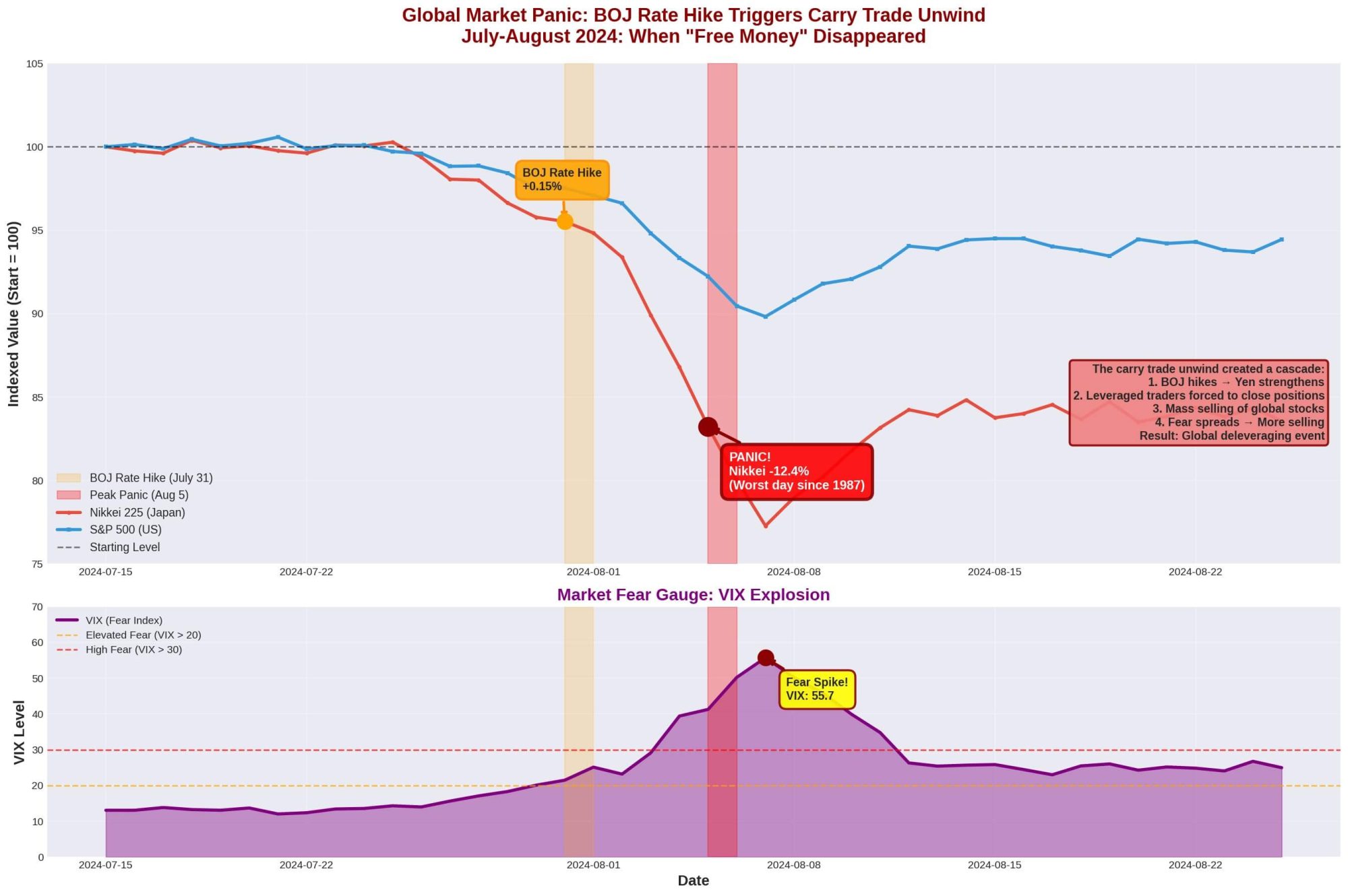

What happened next was described as a “brief but violent global market correction.” That is central banker language. Let me translate: The market panicked.

USD/JPY Carry Trade Unwind

August 2024: When the BOJ hiked rates, the yen strengthened violently as carry trades started unwinding. Source: Financial market data

The yen surged. USD/JPY, which had been trading near 160, suddenly dropped 6% in days. That might not sound like much, but in currency markets that is an earthquake.

The S&P 500 fell sharply. The Nasdaq dropped 8% in a few days. Global equity markets lost trillions in value.

Why? Because when the yen strengthens suddenly, everyone in the carry trade gets hit with a double loss.

First, the assets they bought with borrowed yen are falling in value. US stocks down, bonds down, everything down.

Second, the yen they have to repay is getting more expensive. They borrowed when USD/JPY was 160. Now it is 150. That is a 6% loss on the currency alone, plus losses on the assets.

So what do they do? They panic. They close the trade. They sell everything and buy back yen as fast as possible.

And when trillions of dollars worth of carry trades try to unwind at the same time, you get what we saw in August 2024.

Market Panic and BOJ Decisions

Every time the BOJ moved toward normalization, markets panicked. This is what dependency looks like. Source: Market data synthesis

The really scary part? That was just from a 0.15% rate hike. From 0.1% to 0.25%.

The BOJ has now hiked rates to 0.75% as of December 2025. The fortress is not just cracking. It is crumbling.

And global markets are starting to realize what this means.

The Impossible Choice

Let me explain the corner that the Bank of Japan has painted itself into. It is a corner with no good exits.

Option 1: Keep normalizing rates.

This is what they are doing now. Gradually hiking rates back toward something normal. Maybe 1%, 2%, eventually 3% if they are really serious.

But here is the problem: Decades of zero rates created massive carry trades. Probably $3-4 trillion. Every rate hike makes those trades unprofitable. Every hike triggers more unwinding. More selling of global assets. More yen buying.

If BOJ keeps hiking, the carry trade will continue to unwind. That means global deleveraging. That means a liquidity crisis. That means asset prices collapsing worldwide.

And it means Japan’s own economy suffers too. Japanese companies that invested abroad start losing money. Japanese banks that lent in yen start seeing repayments that hurt their balance sheets. The strong yen crushes export competitiveness.

Option 2: Stop hiking and go back to ultra-loose policy.

Maybe the BOJ gets scared of market volatility. Maybe they see the damage they are causing. Maybe they reverse course and cut rates back to zero or even negative.

This solves the carry trade unwind problem temporarily. Markets stabilize. Asset prices recover.

But now you have a different problem: credibility.

Japan spent 30 years fighting deflation with zero rates. They told the world they were normalizing because inflation was finally sustained at 2%. If they reverse now, what does that say?

It says they do not have control. It says inflation was not actually under control. It says the BOJ is trapped by market reaction and cannot conduct independent policy.

That destroys confidence in the yen. That could trigger a currency crisis. If the yen starts collapsing, Japan faces imported hyperinflation. Energy prices, food prices, everything shoots up.

You cannot run a developed economy with a collapsing currency and runaway inflation. That is the path to social chaos.

So what can they do?

Option 1 causes global financial crisis. Option 2 causes Japanese currency crisis.

There is no Option 3. There is no clever central banker trick that solves this. The problem is too big. The distortions are too deep. The leverage is too extreme.

This is the impossible choice. And it is not unique to Japan.

This is what happens at the end of every fiat currency experiment in history. The authorities manipulate the price of money for so long that the distortions become unsustainable. Eventually they face a choice between deflation-depression or inflation-currency collapse.

Either way, the system breaks.

We have seen this movie before. Weimar Germany in the 1920s. Zimbabwe in the 2000s. Venezuela in the 2010s. Now we are seeing it in slow motion in a developed, sophisticated economy.

The BOJ is not the villain here. They are just the ones holding the bag when the music stops.

The Bigger Picture: 1971 to 2025

Let me zoom out and show you how this fits into the larger story.

In 1971, President Nixon closed the gold window. The last link between the dollar and gold was severed. The world entered a pure fiat currency system for the first time in history.

What happened next? Fifty years of debt expansion. Fifty years of bigger and bigger credit bubbles. Fifty years of lower and lower interest rates needed to service that debt.

In 1980, US interest rates were 15-20%. In 1990, they were 8%. In 2000, they were 6%. In 2010, they were 0%.

You see the trend? Each crisis required lower rates. Each recovery produced more debt. Each debt boom required even lower rates the next time.

By 2008, most developed countries hit zero. They could not go lower. Or so they thought.

Then came negative rates. Europe in 2014. Japan in 2016. The ultimate absurdity. The final stage of the fiat experiment. When you have to pay people to borrow your currency, something is deeply broken.

For eight years, Japan held the line at negative rates. They were the last one still pretending this system could work forever.

Now they are giving up. Rates are going positive. The experiment is ending.

But what comes next?

In 1997, there was the Asian Financial Crisis. Currencies collapsed. Markets crashed. But the system survived. Why? Because rates could still be cut. Because the Fed could ease. Because there was still room to maneuver.

In 2008, there was the Global Financial Crisis. The biggest crash since the Great Depression. But the system survived. Why? Because rates could go to zero. Because central banks could print trillions. Because Japan could go negative.

Now in 2025, we face another crisis. The BOJ carry trade is unwinding. But this time, what is the escape valve?

Rates are already at zero or near zero in many places. Balance sheets are already bloated. Debt is already at record levels. And now even Japan, the last fortress, is hiking rates instead of cutting them.

When the next crisis hits – and the carry trade unwind might be it – where do we go?

What happens when you run out of ammunition? What happens when you have used every trick and there are no tricks left?

Maybe we are about to find out.

What This Really Means (The Part Nobody Wants to Say)

Let me be very clear about what I think is happening.

This is not about Japan. This is not about the yen. This is not even about the carry trade specifically.

This is about the end of a 50-year monetary experiment.

Since 1971, the world has been running on pure fiat currency. Money backed by nothing except government promises and central bank manipulation.

For fifty years, the way the system dealt with every crisis was the same: Print more money. Cut rates. Expand credit. Kick the can down the road.

This created bigger and bigger distortions. More debt. More leverage. More dependence on cheap money. More carry trades.

The BOJ was the final supporter of this system. As long as one major central bank was still printing, still at zero or negative rates, still providing unlimited liquidity, the game could continue.

Now that support is being removed.

What does a $300 trillion global debt bubble look like when the last source of free money goes away?

What do asset markets look like when trillions in carry trades have to unwind?

What does the fiat currency system look like when even central banks start to lose control?

I do not know exactly. Nobody does. But I can tell you this: We are going to find out.

The August 2024 market panic was a preview. That was from a tiny rate hike. Wait until the BOJ is at 1.5% or 2%. Wait until the full scale carry trade unwind happens. Wait until the global margin call arrives.

Some people think central banks will just reverse course. They will cut rates again. Print more money again. Bail everything out again.

Maybe. But then you get the currency collapse scenario. Then you get inflation spiraling out of control. Then you get the loss of confidence in the entire monetary system.

Either path leads to the same place: The fiat experiment ends. The 1971 to 2025 era closes. A new system emerges from the chaos.

That new system might involve digital currencies. It might involve some return to hard money like gold. It might involve a multipolar world with regional currency blocs and no global reserve currency. It might involve something we cannot even imagine yet.

But one thing is certain: The old system, the system built on infinite debt and zero rates and yen carry trades, that system is dying.

The Bank of Japan’s normalization is not just a policy change. It is a funeral bell.

Are we listening?

What Should You Watch?

If you want to track this in real time, here are the key indicators:

- USD/JPY exchange rate: If it falls below 140, the carry trade unwind is accelerating. Below 130 means panic unwinding.

- BOJ policy rate: Every hike accelerates the unwind. Watch for when they reach 1.5%. That is when it gets serious.

- 10-year JGB yield: If Japanese government bond yields spike above 2.5%, it signals major capital repatriation. That means massive selling of US and European assets.

- VIX and market volatility: Sudden spikes in volatility, especially in August 2024 style moves, indicate carry trade stress.

- Gold prices: If gold starts surging while stocks fall, it means people are losing confidence in the whole fiat system.

The story is not over. It is just beginning.

The last fortress is falling. The quiet engine is reversing. The 50-year experiment is ending.

Could this be the moment everything changes?

Maybe we will find out sooner than we think.

________________________________________________________________________________

References and Sources

This analysis draws on research and data from multiple sources:

Primary Central Bank Sources:

- Bank of Japan – Policy Decisions and Statements, 2024-2025: https://www.boj.or.jp/en/

- Bank for International Settlements – “The market turbulence and carry trade unwind of August 2024”: https://www.bis.org/publ/bisbull90.htm

- Federal Reserve Economic Data (FRED) – Interest Rate Data: https://fred.stlouisfed.org/

- Trading Economics – Japan Interest Rate Historical Data: https://tradingeconomics.com/japan/interest-rate

Market Analysis and Commentary:

- FinancialContent – “The Yen’s Revenge: How the Bank of Japan’s Final 2025 Hike Sent Shockwaves Through Wall Street”: https://markets.financialcontent.com/wral/article/marketminute-2025-12-19

- FinancialContent – “The Tokyo Ripple: Bank of Japan’s Historic Rate Hike Sends Global Yields Climbing”: https://markets.financialcontent.com/stocks/article/marketminute-2025-12-19

- MEXC Blog – “Yen Interest Rate Hike Coming? In-Depth Analysis of Impact on Global Financial Markets”: https://blog.mexc.com/news/yen-interest-rate-hike-coming-in-depth-analysis-of-impact-on-global-financial-markets/

- FXStreet – “Bank of Japan set to raise interest rates to highest level in 17 years”: https://www.fxstreet.com/news/bank-of-japan-set-to-raise-interest-rates-to-highest-level-in-17-years-202501232300

- Mesirow – “The quiet engine of global risk”: https://www.mesirow.com/insights/quiet-engine-global-risk

- Pearson Business School – “The carry trade time bomb”: https://pearsonblog.campaignserver.co.uk/the-carry-trade-time-bomb/

News and Analysis:

- CNBC – “Bank of Japan makes landmark shift away from negative rates”: https://www.cnbc.com/2024/03/19/bank-of-japan-boj-march-2024-policy-decision-mpm-meeting.html

- EFG International – “Bank of Japan exits its negative interest rate policy”: https://www.efginternational.com/us/insights/2024/bank_of_japan_exits_its_negative_interest_rate_policy.html

- World Economic Forum – “Japan ends negative interest rates: Here’s what it means for the economy”: https://www.weforum.org/stories/2024/03/japan-ends-negative-interest-rates-economy-monetary-policy/

- NBC News – “Bank of Japan hikes rates for first time in 17 years, abolishes yield curve control”: https://www.nbcnews.com/news/world/bank-japan-hikes-rates-first-time-17-years-abolishes-yield-curve-contr-rcna144004

Technical Analysis and Educational Resources:

- Bramesh’s Technical Analysis – “Understanding the Yen Carry Trade: A Comprehensive Guide”: https://brameshtechanalysis.com/2024/08/05/understanding-the-yen-carry-trade-a-comprehensive-guide/

- Forexearlywarning – “Forex Trading, The Domino Effect”: https://www.forexearlywarning.com/forex-lessons/the-domino-effect

- FasterCapital – “The Domino Effect: Breaking the Buck and Systemic Risk”: https://fastercapital.com/content/The-Domino-Effect–Breaking-the-Buck-and-Systemic-Risk.html

- Quickonomics – “Domino Effect Definition & Examples”: https://quickonomics.com/terms/domino-effect/

- Menthor Q – “The Yen Carry Trade and its Global Implications”: https://menthorq.com/guide/the-yen-carry-trade-and-its-global-implications/

- Trader’s Log – “Carry Trade”: https://www.traderslog.com/carry-trade

Academic and Research:

- ResearchGate – “Contagion as a Domino Effect in Global Stock Markets”: https://www.researchgate.net/publication/257211487_Contagion_as_a_Domino_Effect_in_Global_Stock_Markets

- Substack – “THE ARCHITECTURE OF TRANSITION”: https://shanakaanslemperera.substack.com/p/the-architecture-of-transition

All data, statistics, and factual claims in this article are derived from these publicly available sources. No information has been fabricated or invented.

Yasal Uyarı: Bu analiz yalnızca bilgilendirme ve eğitim amaçlıdır ve finansal veya yatırım tavsiyesi olarak değerlendirilmemelidir. Tüm veriler ve tahminler, Aralık 2025 itibarıyla kamuya açık kaynaklara dayanmaktadır. İfade edilen görüşler yazarın görüşleridir ve herhangi bir menkul kıymet veya varlığın alım veya satımına ilişkin tavsiye niteliği taşımaz. Yatırımcılar, herhangi bir yatırım kararı vermeden önce kendi araştırmalarını yapmalı ve nitelikli finansal uzmanlara danışmalıdır. Geçmiş performans, gelecekteki sonuçların göstergesi değildir.

________________________________________________________________________________

Arzu Alvan tarafından yapılan analiz – Aralık 2025