2025 wasn’t just another year in global finance—it was a snapshot of a world in transition. While headlines focused on stock market swings and oil price spikes, something more fundamental was happening beneath the surface: the slow, steady erosion of the dollar’s decades-long grip on the global financial system. For investors and anyone watching the economic tea leaves, understanding this shift isn’t optional anymore. It’s essential.

A Year That Mattered

Let me start with what we saw in March. The markets were, frankly, all over the place. U.S. stocks couldn’t decide which direction they wanted to go, buffeted by economic data that refused to tell a clear story and geopolitical tensions that kept everyone on edge. Meanwhile, European markets were having a moment—strong economic numbers and lower energy costs gave them a rare chance to outshine their American counterparts.

Emerging markets? They weren’t so lucky. A strengthening dollar—more on that in a moment—combined with geopolitical uncertainties made life difficult for economies from India to Brazil. Their currencies took a beating, and their central banks found themselves in the uncomfortable position of fighting both depreciation and inflation at the same time.

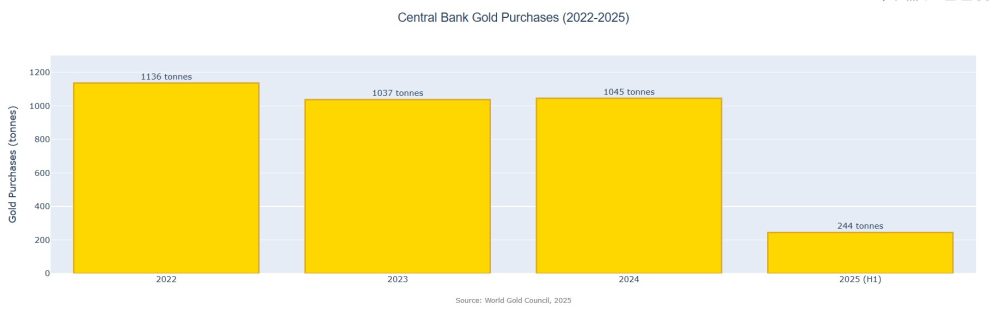

On the commodity front, oil prices surged thanks to OPEC’s production cuts and fresh tensions in the Middle East. Gold held steady, doing what it does best: serving as a hedge when uncertainty rises. Central banks around the world kept buying it up, a trend that’s become impossible to ignore. Silver benefited from industrial demand, while platinum struggled as manufacturing activity cooled.

The Currency Dance

Here’s where things get interesting. The dollar strengthened in March, driven by the Federal Reserve’s cautious approach to rate cuts and good old-fashioned safe-haven demand. When the world gets nervous, money flows to the dollar. It’s been that way for decades, and March 2025 was no exception.

But the euro gained ground too, supported by positive data coming out of the Eurozone. And that’s the paradox we’re living in right now: the dollar can strengthen in the short term while simultaneously losing ground in the long term. It’s like watching a heavyweight champion who’s still winning fights but can feel the younger contenders closing in.

The Bigger Picture: Dollar Dominance Under Pressure

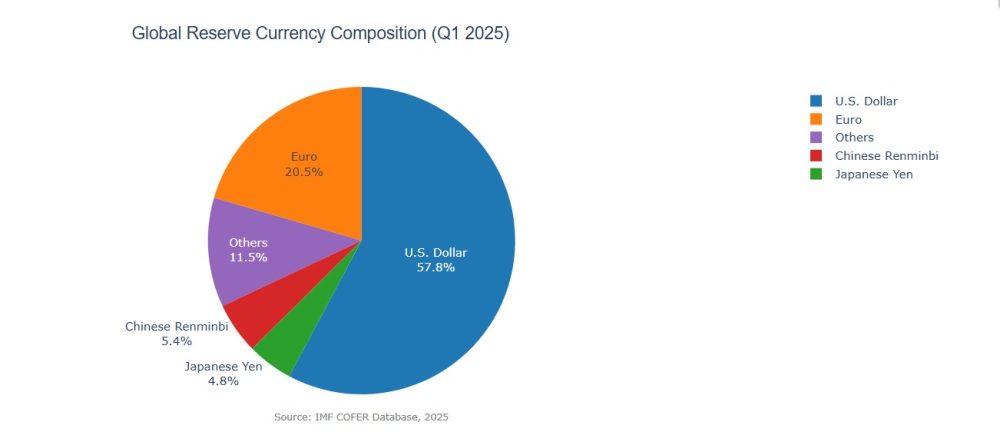

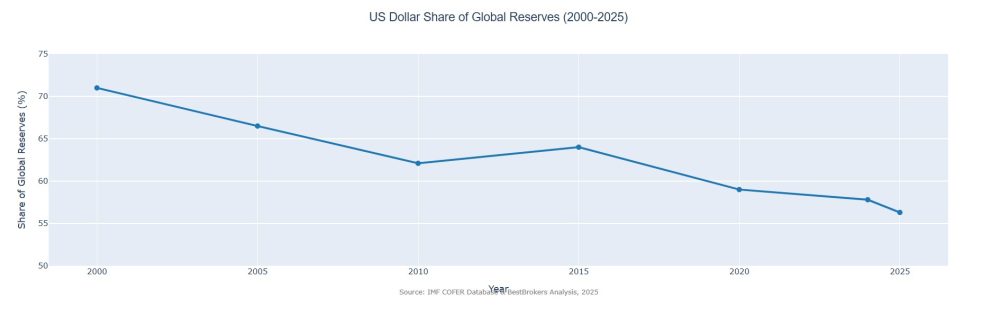

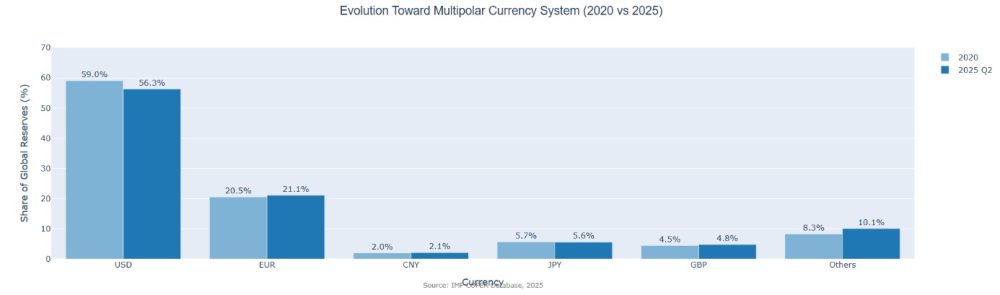

Now, let’s zoom out. The dollar remains the world’s dominant reserve currency—that’s not in question. But its share of global reserves has been sliding, and the trend is accelerating. According to the International Monetary Fund, the dollar’s share dropped to 56.32% in Q2 2025, down from 57.79% in Q1. That might not sound dramatic, but in the world of reserve currencies, it’s significant.

To put this in perspective, the dollar commanded 71% of global reserves back in 2000. We’ve lost nearly 15 percentage points in a quarter century. The decline has been gradual, almost imperceptible year to year, but the cumulative effect is undeniable.

Where’s the Money Going?

So if central banks are diversifying away from the dollar, where’s the money going? The euro has picked up some of the slack, rising to 21.13% of reserves in Q2 2025. But here’s what surprised me: it’s not just about the euro or even the Chinese renminbi (which remains stuck around 2% despite all the talk of de-dollarization).

The real story is the rise of what economists call “non-traditional” reserve currencies—the Canadian dollar, Australian dollar, Swedish krona, South Korean won. These currencies collectively now account for over 10% of global reserves. That’s a quiet revolution happening in plain sight.

And then there’s gold. Central banks have been on an absolute buying spree. In 2024 alone, they purchased 1,045 tonnes—the third consecutive year above 1,000 tonnes. Poland led the charge with 90 tonnes, followed by Turkey, India, and China. Even in Q1 2025, purchases remained 25% above the five-year average at 244 tonnes, according to the World Gold Council.

“When central banks buy gold at this pace, they’re not just diversifying—they’re hedging against a future where the dollar’s dominance can’t be taken for granted.”

Why This Is Happening

The reasons behind this shift are complex, but three factors stand out to me as particularly important:

- Geopolitical Fragmentation

The world is fracturing into competing blocs, and that’s changing how countries think about their reserves. When Russia’s foreign exchange reserves were frozen in 2022, it sent shockwaves through central banks everywhere. Suddenly, holding dollar-denominated assets wasn’t just an economic decision—it was a geopolitical vulnerability. Countries started asking themselves: “Could this happen to us?”

The answer, for many, was to diversify. Not necessarily to abandon the dollar entirely—that’s neither practical nor desirable for most—but to reduce concentration risk. It’s the same logic any investor would apply to their portfolio, just on a national scale.

- U.S. Fiscal Challenges

Let’s talk about the elephant in the room: America’s fiscal situation. The U.S. ran a deficit of $1.8 trillion in fiscal year 2025—that’s 5.8% of GDP. The trade deficit sits at 4.2% of GDP. And public debt? It’s now 125.3% of GDP, nearly double the 50-year historical average.

Key U.S. Fiscal Metrics (2025):

- Fiscal Deficit: 5.8% of GDP ($1.8 trillion)

- Trade Deficit: 4.2% of GDP

- Public Debt: 125.3% of GDP ($30.3 trillion)

Source: Congressional Budget Office (CBO) & U.S. Treasury Department, 2025

Now, I’m not predicting an imminent crisis. The U.S. has unique advantages—deep, liquid financial markets; strong institutions; the ability to borrow in its own currency. But these numbers matter. They create long-term questions about the dollar’s stability that central banks can’t ignore.

- The Rise of Alternatives

Technology is changing the game. Central bank digital currencies (CBDCs) are no longer theoretical—they’re being tested and implemented. China’s e-CNY is already in use domestically, and projects like mBridge are exploring how multiple CBDCs can work together for cross-border payments.

These aren’t dollar-killers, at least not yet. But they’re creating infrastructure for a world where the dollar is one option among many, rather than the only option that matters. That’s a fundamental shift.

What a Multipolar Currency System Actually Looks Like

Here’s what I think people get wrong about de-dollarization: it’s not about the dollar being replaced by a single alternative. The euro tried that and plateaued. The renminbi has potential but faces serious constraints from China’s capital controls and lack of financial transparency.

What we’re moving toward is messier and more complex—a multipolar system where the dollar remains first among equals, but where “equals” actually means something. Regional currencies will matter more. Gold will play a bigger role. Digital currencies will carve out their niches.

Think of it less like a regime change and more like a gradual rebalancing. The dollar won’t collapse, but its monopoly is ending. For investors, that means thinking differently about currency exposure, about diversification, about what “safe” really means in a multipolar world.

What This Means for Investors

So what should you actually do with this information? A few thoughts:

First, don’t panic. The dollar’s decline is gradual, measured in years and decades, not months. The infrastructure supporting dollar dominance—from SWIFT to Treasury markets—isn’t going anywhere soon. But don’t be complacent either.

Second, think about diversification differently. Currency diversification isn’t just for central banks. Consider exposure to assets denominated in euros, yen, or even some of those non-traditional reserve currencies. Gold deserves a place in most portfolios—if central banks are buying this aggressively, there’s probably a reason.

Third, watch the fiscal numbers. U.S. debt dynamics matter more in a multipolar world. If the trajectory doesn’t change, it will accelerate the shift away from dollar dominance. That has implications for everything from Treasury yields to the dollar’s exchange rate.

Finally, pay attention to geopolitics. The financial system is becoming more fragmented along geopolitical lines. That creates both risks and opportunities. Companies and investors who can navigate multiple currency zones will have advantages over those who can’t.

The Bottom Line

2025 gave us a clear view of where we are in this transition. The dollar is still dominant, but its dominance is eroding. Central banks are diversifying. Alternative currencies and assets are gaining ground. The infrastructure for a multipolar system is being built.

This isn’t a crisis—it’s an evolution. But evolution can be disruptive, especially for those who aren’t paying attention. The investors who thrive in the coming decades will be those who understand that the financial world of 2025 is fundamentally different from the one we knew in 2000, and that the world of 2040 will be different still.

The dollar’s reign isn’t over. But it’s no longer absolute. And that changes everything.

Analysis by Arzu Alvan

References & Data Sources

- International Monetary Fund (IMF). (2025). Currency Composition of Official Foreign Exchange Reserves (COFER). Available at: https://data.imf.org/COFER

- BestBrokers. (2025). Global Reserve Currency Landscape 2025: U.S. Dollar Shifts from Dominant Force to Record Low Share. Available at: https://www.bestbrokers.com/forex-brokers/global-reserve-currency-landscape-2025

- World Gold Council. (2025). Central Bank Gold Statistics. Available at: https://www.gold.org/goldhub/gold-focus/2025

- Congressional Budget Office (CBO). (2025). The Budget and Economic Outlook: 2025 to 2035. Available at: https://www.cbo.gov/publication/60870

- U.S. Treasury Department. (2025). Monthly Treasury Statement. Available at: https://home.treasury.gov/data

- J.P. Morgan. (2025). De-dollarization: The End of Dollar Dominance? Available at: https://www.jpmorgan.com/insights/global-research/currencies/de-dollarization

- Institute of Geoeconomics. (2025). From Dollar Hegemony to Currency Multipolarity? Available at: https://instituteofgeoeconomics.org/en/research/2025062121/

- Federal Reserve. (2025). The International Role of the U.S. Dollar: 2025 Edition. Available at: https://www.federalreserve.gov/econres/notes/feds-notes

- Reuters. (2025). Dollar Cedes Ground to Euro in Global Reserves, IMF Data Shows. Available at: https://www.reuters.com/business

- Gainesville Coins. (2025). Central Bank Gold Purchases: Investor Guide 2025. Available at: https://www.gainesvillecoins.com/blog

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. All data and projections are based on publicly available sources as of March 2025. Investors should conduct their own research and consult with financial professionals before making investment decisions.